Protect Your Cash in the Bank

Cash sweeps are not new, but they are increasingly relevant to gain peace of mind.

IntraFi Network Deposits, also known as Insured Cash Sweep (ICS) and CDARS (Certificate of Deposit Account Registry Service), are innovative deposit placement services that enable investors to access FDIC insurance coverage on deposits exceeding the $250,000 limit per depositor, per institution.

In this article, we’ll explore what IntraFi Network Deposits are, how they work, and their benefits.

What are IntraFi Network Deposits?

IntraFi Network Deposits are deposit placement services that provide access to FDIC insurance coverage on deposits above the $250,000 limit per depositor, per institution. These services enable investors to effortlessly spread their deposits across multiple banks in the IntraFi network, ensuring that their deposits remain fully insured.

There are two primary IntraFi Network Deposit services: ICS and CDARS. ICS enables investors to place funds in demand deposit accounts, money market deposit accounts, or savings deposit accounts that are spread across multiple banks in the IntraFi network. CDARS, on the other hand, enables investors to place funds in CDs that are also spread across multiple banks in the IntraFi network.

How do IntraFi Network Deposits work?

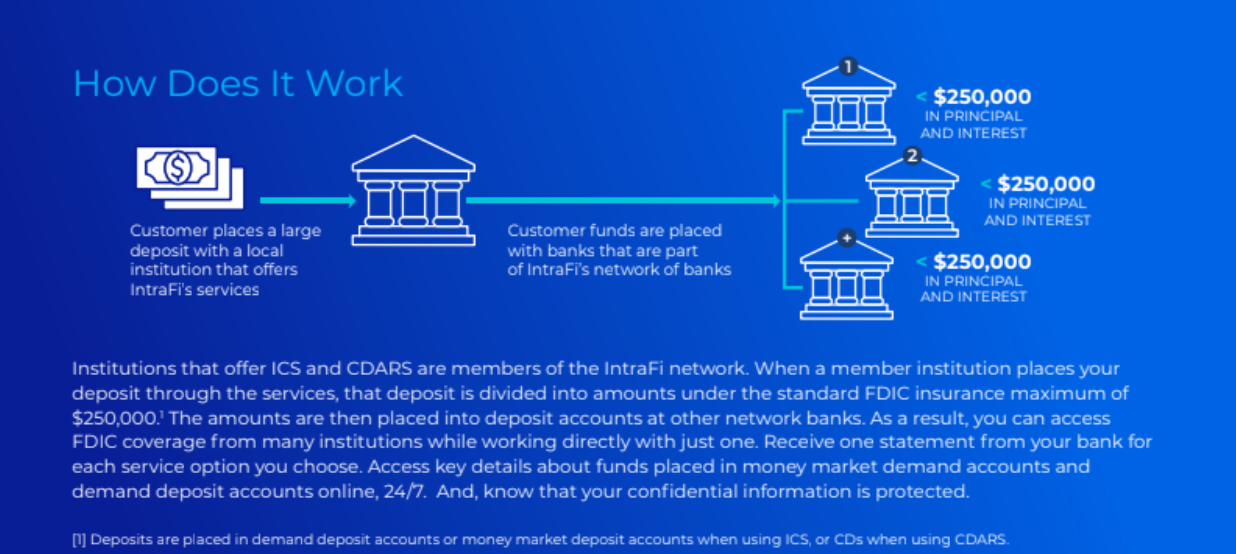

To use IntraFi Network Deposits, investors work with a participating financial institution, such as a bank or credit union. The participating financial institution serves as the investor’s single point of contact and manages the entire deposit placement process on behalf of the investor.

When an investor places funds using ICS, the participating financial institution places the funds in deposit accounts at other banks in the IntraFi network, ensuring that each deposit account is within the FDIC insurance limits. This enables investors to receive one consolidated statement from the participating financial institution, simplifying account management.

With CDARS, the participating financial institution purchases CDs from other banks in the IntraFi network on behalf of the investor. The CDs are issued in denominations below the FDIC insurance limit, ensuring that each CD is fully insured. The participating financial institution then consolidates the CDs into a single account for the investor, simplifying account management.

What are the benefits of IntraFi Network Deposits?

There are several benefits to using IntraFi Network Deposits. First and foremost, they enable investors to access FDIC insurance coverage on deposits exceeding the $250,000 limit per depositor, per institution. This provides investors with peace of mind, knowing that their deposits are fully insured.

In addition, IntraFi Network Deposits provide investors with convenience and simplicity. With ICS, investors can place funds in demand deposit accounts, money market deposit accounts, or savings deposit accounts, making it easy to access their funds when needed. With CDARS, investors can purchase CDs with varying maturities, enabling them to structure their investments to meet their specific needs.

Finally, IntraFi Network Deposits enable investors to work with a single participating financial institution, simplifying account management. Investors receive one consolidated statement and work with a single point of contact for all of their deposit placement needs.

Conclusion

IntraFi Network Deposits are a proven deposit placement service that enables investors to access FDIC insurance coverage on deposits exceeding the $250,000 limit per depositor, per institution. These services provide investors with peace of mind, convenience, and simplicity, making it easy to manage their deposits and access their funds when needed. If you’re looking for a way to ensure that your deposits are fully insured, consider working with a participating financial institution that offers IntraFi Network Deposit services.

Our Growth CFOs help your company increase positive cash flow and protect your assets through IntraFi Network Deposits. Schedule a 25 Minute Discovery Call with me today!